Although you have adopted the registered address during the incorporation process, you can change the address from time to time. As the registered address is of vital importance that used to receive all statutory mail, correspondences and notice from the government, you must notify the change to Companies Registry, Inland Revenue Department and Business Registration office in a timely manner. It should be noted that the registered office address does not necessarily need to be the place where you conduct and operate your business.

How to change the registered office address

The process of changing a registered address is simple though it involved several government departments. Before you start the notification to the government, a board resolution should be passed to resolve the change of registered address and stating the new registered address. Then, you can file a notification of change of registered office ( Form NR1) with the Companies Registry within 15 days after the change is made. Apart from Companies Registry, you should also notify the Inland Revenue Department and Business Registration Office within one month after the change by filing the form IRC3111A. If necessary, inform the bankers as well. If the statutory records, such as the Registers of Members and Registers of Directors, are not kept in the registered office address, you should notify the location of statutory records by filing a form NR2 with Companies Registry.

How to fill in the form NR1

Filling the form NR1 is simple and straightforward as there is only one page of the form. You do not have to submit any other supporting documents. To download the form NR1, go to the website of Companies Registry, click “Forms”, “ Specific Forms” then “ Local company and registered non-Hong Kong company”.

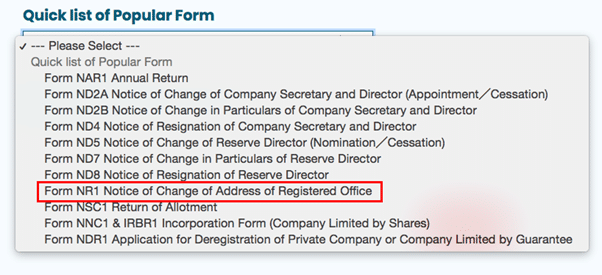

You can see a list of forms from the quick search, choose “Form NR1 Notice of Change of Address of Registered Office”.

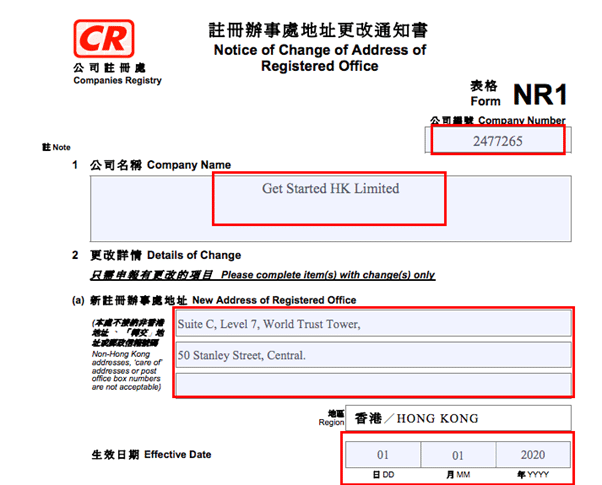

Once you download the document, you are ready to fill in the information stated on it. You can start with the company number which is shown on your Certificate of Incorporation, your company name that should be case-sensitive, and your new registered office address.

Do not forget to include the effective date of the change, the effective date should be the same as stated in the board resolution. If you are not changing the email, or you have never filled the email information with Companies Registry, you can leave this item blank.

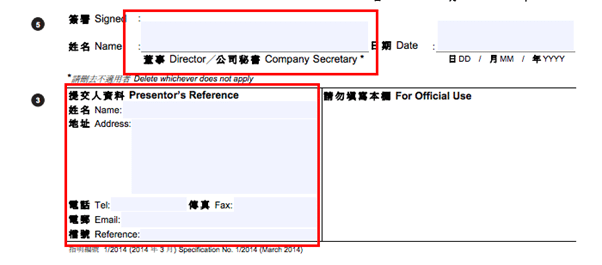

Meanwhile, sign the form on item 5 and state your position in the company. Please also date the form as current date. At last, insert the presentor’s information such as name, address and telephone number.

How to notify your change of registered address to Inland Revenue Department

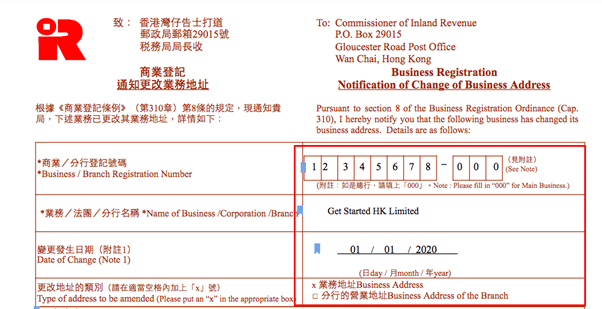

To notify the change of registered address, you must file a form IRC3111A to Inland Revenue Department within one month of the change. To begin with, complete the table of the form by stating the business registration number (that is shown on the business registration license), your company name, the date of change and the type of address to be amended. If you would like to change the business address only, put an X in the box ‘Business Address’.

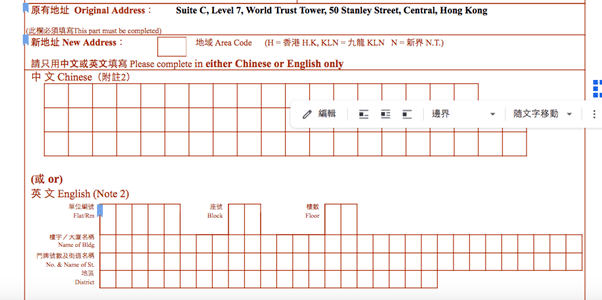

After that, you should state your original address (the one you are using before the change), and put down the new address in either Chinese or English accordingly. Do not forget to state the area code in the box as instructed.

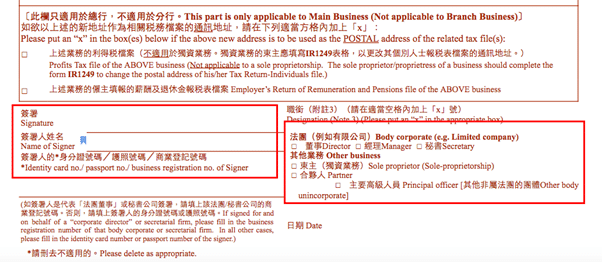

If you want to change the address for the profit tax file and the employee’s return of remuneration and pensions file simultaneously, put an X in the appropriate boxes. Hence, the government would send the tax returns, notices of assessment and other correspondence to your new postal address.

For the last step, sign and state your name, position and identity details, as well as the date.

The process of changing a registered office address is simple though it involves several government authorities. One careless mistake could lead to a huge delay in the notification of change of address. Therefore, if you wish to seek for professional advice to ensure the change is in good order, we Get Started HK would be happy to help. If you need more information on the above matter, you can contact us at info@getstarted.hk, our incorporation expert will get back to you soon. Thanks for reading.